Table of Contents

In this article, we will identify some of the possible causes that could lead to a bank reconciliation company error and after that, we will suggest some potential repair methods that you can try to resolve the issue.

Updated

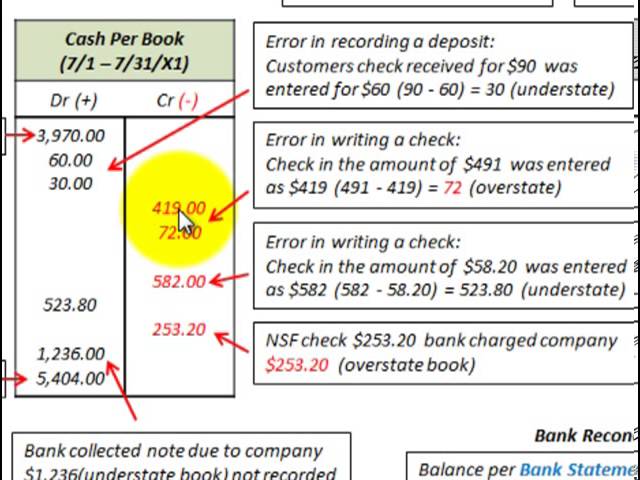

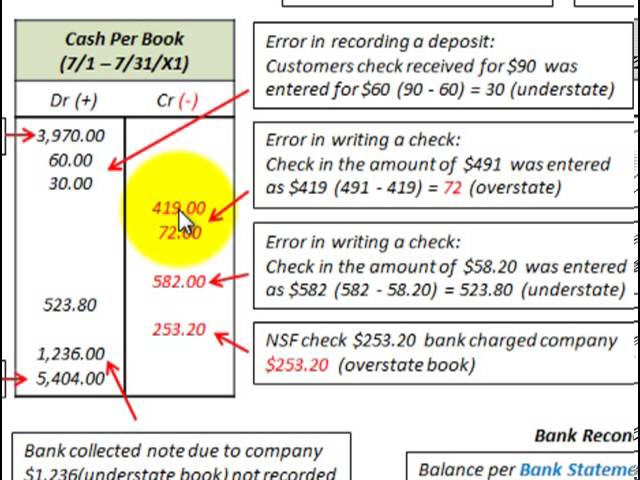

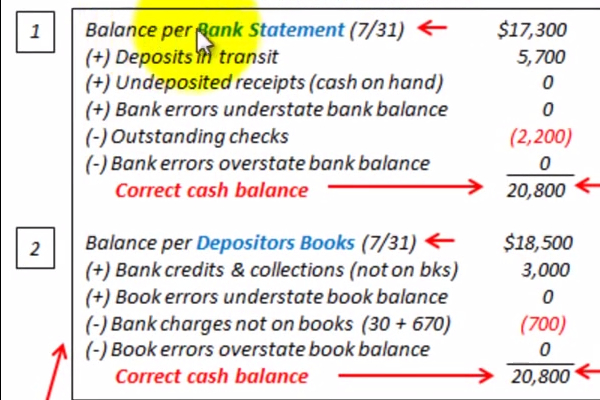

Businesses and banks sometimes make absolute mistakes. If a business suddenly registers a transaction, the account balance must be adjusted in the ledger during the cash comparison, and the adjustment entry must be posted and posted to the appropriate ledger.

How do you record a company error in a bank reconciliation?

Bank errors will be corrected if you ask your bank to reconcile the accounting records. Subtract or add so that you have a balance depending on whether your current error left more, and sometimes less, than it actually did.

Bank Errors: Reconciliation Examples

Having to fix a miraculous check entry error is just one of the reasons why you need to generate a regular account statement. The Accountant Coach email lists other examples of bank reconciliation errors:

How do you reconcile bank errors?

Receive bank statements.Collect business documents.Find a starting point.Review your bank deposits and withdrawals.Check income and expenses in reliable books.Adjust bank statements.Adjust the dosha balance.Compare the resulting balances.

Your Property Manager Can Process Your Bank Reconciliations

In our Rowcal, property managers can keep all records of the actual HOA, including bank reconciliations. We use cloud-based online software that allows our accountants to work with your HOA treasurer to keep an accurate record of your transactions. We can help you make sure you always know exactly how much you actually have in your bank account.

Here Are Some Key Caveats That Many People Make When Preparing To Reconcile Their Bank Accounts :

H2> A Common Mistake, Whether You Use A Manual Ledger Or A Spreadsheet, Is That It May Not Generalize Clearly. Undoubtedly, It Is Quite Possible That The Error Mayhiccup When Using Calculator To Balance Payments Or Accounts.

What Is Bank Reconciliation?

Bank reconciliation is definitely a monthly process, at this time we are developing bank document activities, to ensure that everything is recorded in the books of the company or individual. As we all move towards more automated and electronic transactions, this is an extremely important and crucial step in ensuring the accuracy and stability of liquidity.

Company Records

Records (or books) Company records refer to records in the general ledger, but may also take the form of a resource payment book, receipt book, general ledger entries, or capital transaction lists. Example of a cash register database:

What Is An Account Statement?

A bank reconciliation is a report of any type of banking and commercial transactions that reconciles a company’s bank account with its own financial records. The statement describes the funds, withdrawals, and other activities affecting the account during a certain period of time.about a period of time. The Absolute Bank Reconciliation Statement is a useful affordable financial control tool used to prevent fraud.

What Is A Reconciliation Between Banks?

A reconciliation report is, of course, a document that compares cash balances with a company’s balance sheet in simple financial statements. Financial statements are of great importance for financial modeling and accounting. successfully transfer the appropriate amount to your bank comment. Reconciling the two accounts will help determine whether accounting changes are needed or not. Bank reconciliations may be conducted periodically to ensure the accuracy of the Company’s books. They also help detect fraud. Biggest Accounting Scandals The last few decades have seen some of the worst accounting scandals in history. Billions of dollars have been lost due to various financial disasters. and any cash transactions.

Updated

Are you tired of your computer running slow? Annoyed by frustrating error messages? ASR Pro is the solution for you! Our recommended tool will quickly diagnose and repair Windows issues while dramatically increasing system performance. So don't wait any longer, download ASR Pro today!

What Is Bank Reconciliation?

Bank reconciliationA check is the process of reconciling the balance in a company’s accounting records with the cash account balance with the corresponding information on the Income Statement. The purpose of this process can be described as identifying the differences between them and accounting for changes to the project record, if any. Each of our bank statement information is a bank record relating to all transactions that have affected the payment of the banking unit during the last month. Off,

What is the purpose of bank reconciliation?

The bank’s goal is to get back together. Bank reconciliation is used and your records are compared with your bank records to see if there are any differences between the two for these cash transactions.

First, What Is A Bank Reconciliation?

When you “reconcile” your bank file or records, you compare them with your accounting records for the same period and identify any inconsistencies. You then need to document these inconsistencies so that the client or your accountant can determine that no money was “lost” from the transaction.

What is bank errors in bank reconciliation?

BankingSome mistakes are proposals that were incorrectly entered into the client’s finances by one bank. These errors are commonly seen during the monthly bank reconciliation process by customers who notify the lending company to correct the specified points.

Bank Reconciliation Review

debt. This is a way to compare bank accounts receivable with the company’s personal records to detect inconsistencies, payment Any mistakes, manipulations or unexpected expenses.

What is an example of bank reconciliation?

Examples of device reconciliation in bank reconciliation are usually

Speed up your computer today with this simple download.What is the importance of bank reconciliation?

Bank reconciliation is an important accounting process that is performed by businesses of all sizes.

What does bank reconciliation mean?

Bank reconciliation. Bank recovery is a process that usually explains

Ошибка компании по выверке банковских счетов

Bedrijfsfout Bankafstemming

Errore Società Di Riconciliazione Bancaria

Błąd Firmy Uzgodnienia Bankowego

Erro Da Empresa De Reconciliação Bancária

Fehler Bei Der Bankabstimmungsfirma

Error De Empresa De Conciliación Bancaria

Bankavstämning Företagsfel

은행 조정 회사 오류

Erreur De Société De Rapprochement Bancaire