Table of Contents

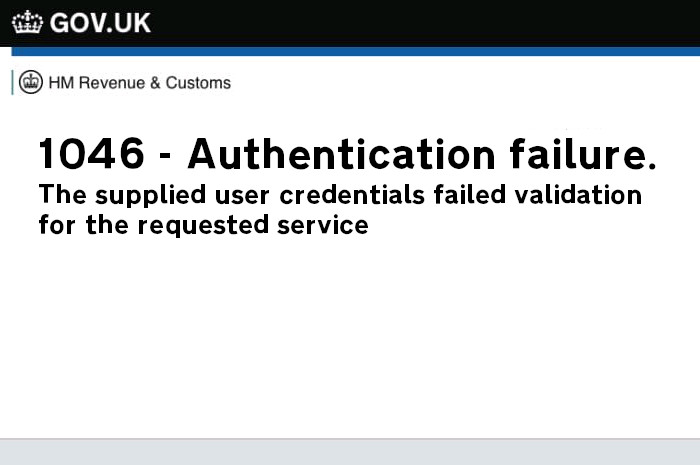

Over the past few weeks, some of our users have encountered Gateway Error 1046. This issue occurs for a number of reasons. Let’s discuss them below.

Updated

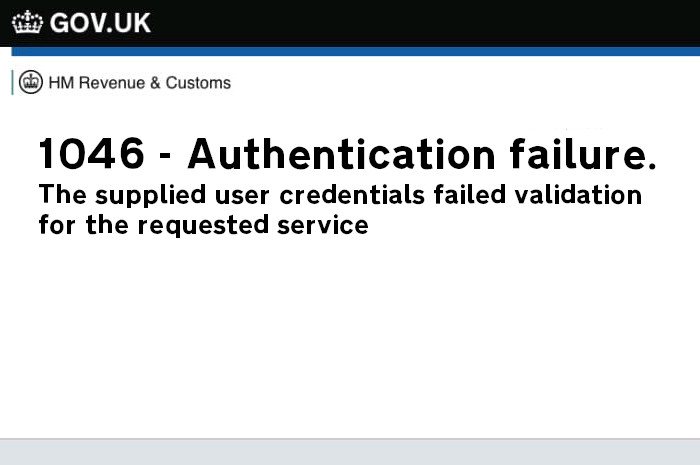

Bug 1046: Authentication Failure is the most common problem when verifying your live submission to HMRC. BrightPay sends this information to be activated at the government gateway. If you get this 1046 process error, it means the government gateway rejected the submission.

If you try to file your tax return online through this “Internet file”Function (FBI) appears with the thought “Gateway Authentication Error”.

Gateway Error 1046 Authentication Failed: The user’s generic credentials could not verify the requested servicemay be reported upon filing a tax return if one or more pieces of information relate to credentials verified through the HMRC government gatewayThe servers could not be verified, so the gateway rejects your delivery attempt.

The Internet file process in software reads the message returned through the gateway and displays a gateway authentication error message.

If you receive a messageIf you see a personal gateway authentication error, please make sure the following information is entered correctly.

For Andica SA100 Self-Assessment Software:

- Unique taxpayer link (UTR) for the taxpayer.

- Gateway user ID (personal taxpayer ID or agent ID).

- Gateway password (personal taxpayer password or agent password)

- If you are applying as an individual using your own Private Gateway User ID and Password, please make sure a Self-Assessment (SA) is performed.The service has been activated in connection with the HMRC site. The service must be offered in the Services You May Use section.

For Andica SA800 Partnership Tax Return Software:

- Partnership Tax Records (UTR)

- Gateway User ID (Sales Agent ID)

- Gateway Password (for Sales Agent Password)

- When registering a company as a partnership, use your user ID andgateway password. If you are considering a company, be sure to have a self-assessment (SA) done.for partnership, the service is activated on the HMRC website. The service must be listed in the Services You May Use section.

The gateway UTR, user ID, and gateway password of the partner company do not belong to the same partner in the current company.

For Andica SA900 Escrow And Inheritance Reporting Software:

- Income Tax (UTR) Help

- Gateway user ID (for trust, real estate agent or ID)

- Gateway password (for trust or real estate agent or password)

- If the keeper uses the gateway user id, the password forTrust or estate, make sure you have a Self-Assessment Service (SA) for the trustand Estate have been activated on the HMRC website. The service should be listed under the “Services You Can Really Use” section.

For Andica CT600 Corporate Tax Software:

Make sure that all of the following information is entered correctly. These ssyLips and identifiers refer to the company and not to the member of the board of directors.

- Company Tax Record (should be similar to CT603).

- Gateway ID (for business) as entered by HMRC or government gateway – no spaces.

- Gateway password (for a specific company).

- Also make sure you register with the HMRC Tax Company Service and request the service on the HMRC / GOV.UK website. The service must be listed under the Services You May Use or Your Tax Account.

If you have saved your login credentials (gateway user ID and gateway password) for previous sending attempts,Delete the offers and uncheck the box next to “Will the customer keep their connection details?” Enter your gateway user ID and password again.

Validate If agents have entered gateway authentication information on the accountant screen, the gateway ID and agent password must also be deleted and re-entered.

HMRC may be canceled for the following reasons for authentication presented й

Invalid login details

When submitting a payroll supplement over the Internet, your gateway user county ID, password, and recipient number (tax and reference point number) are compared with records stored in HMRC systems. If one or more of these values do not match, you will definitely get error 1046. User

invalid username and password

This is the most common cause of error 1046. A good way to verify your user ID and password is to go to the HMRC login site and log in with your user ID and password

When you see the password on the HMRC website, only the first 12 digits are accepted. If you specify it in your computer software, the computer software will almost recognize the numbers, so anything after the first 12 will be considered incorrect, resulting in error 1046. If your password is more than 12 digits, use only the first 12 digits. payroll software.

If you are unsure of these details, please contactHMRC Online Services Support on 0300 200 3600. You can also change the password reset task here.

Please Note: A security feature also used by HMRC means that if you enter your username or password three or more times when logging in to access HMRC, your account will be locked. You cannot guarantee that you will be using HMRC Online Services within two new hours. After the two hour session, you can try again. Link PAYE

Check

Wrong. Tax District and Reference are registered and authorized by you to file RTI returns online.

The “Tax District” field must contain 3 digits (example: 123). Other information (for example, AB45678) must be entered in the Tax Reference field. You don’t have to just put a forward slash on virtual farmland. This causes the sending to fail. District

false name

There were cases when some of the documents were not accepted due to the incorrect name of the VAT district.

Check the county name with the HMRC to ensure that the the correct information is usually used in your payroll software.

If everyone sees their correct Personal ID, County Password, Referral Number, and Amount, make sure HMRC is awaiting a PAYE for that account.

Not registered with the service

If PAYE is not listed in your services at the time of the employer, you must register for this before you can save your history online.

Not for an activated service

After subscribing to a specific service, you should receive an activation rule. The activation code will be re-issued in a few days – use it once and throw it away. Your family will lose it if you do not use it within 28 days of the date in the letter. You must request a new one.

You cannot submit an online application if someone has not registered with PAYE for employers and activated this business.

Submit a quote to the old HMRC service a few weeks ago

HMRC has changed the web address (URL) you are usinguse to send your RTI materials. This change may not have been replicated in your local security system.

You will probably need to change the programming of your security software (antivirus / firewall) for all connections with the following addresses:

To continue receiving emails from HMRC, you may need to add the following addresses to your email whitelist, secure login, no spam:

Contact your IT support, security software, or email provider for help.

If all of the above is checked, but this error is still displayed, you can force the program to recreate the connection data that was used to submit your claims.

Review the payroll software creation file. If you don’t know where to go, right-click on the salary shortcut and select the Open music file location option.

When you seeFor the list of files and directories, find the RTI.CONFIG file.

Return to the payroll program and resubmit your application. This may force the program to make a clean copy of the RTI.CONFIG file

Auto shutdown in web browser

In some cases, the above error was caused by the automatic shutdown of the web browser by entering incorrect information into the forms.

Speed up your computer today with this simple download.

Gateway-Fehler 1046

Errore Gateway 1046

Gateway-fout 1046

Erreur De Passerelle 1046

게이트웨이 오류 1046

Erro De Gateway 1046

Gateway -fel 1046

Błąd Bramy 1046

Ошибка шлюза 1046

Error De Puerta De Enlace 1046