Table of Contents

Updated

In recent days, some users have encountered an error code with VAT penalties if they are not registered. This problem occurs due to many factors. Let’s look at them now. The penalty can be up to 100% of the VAT shown on the actual invoice. There is a minimum penalty of 10% VAT even if it is an unsolicited HMRC disclosure regarding a clerical error rather than prepared and secret conduct.

What happens if not VAT registered?

Value Added Tax is undoubtedly a value added tax. This is a profit tax levied by merchants subject to VAT on the value of goods or places supplied to their customers.

What Happens If I Start Collecting VAT If I’m Not Registered?

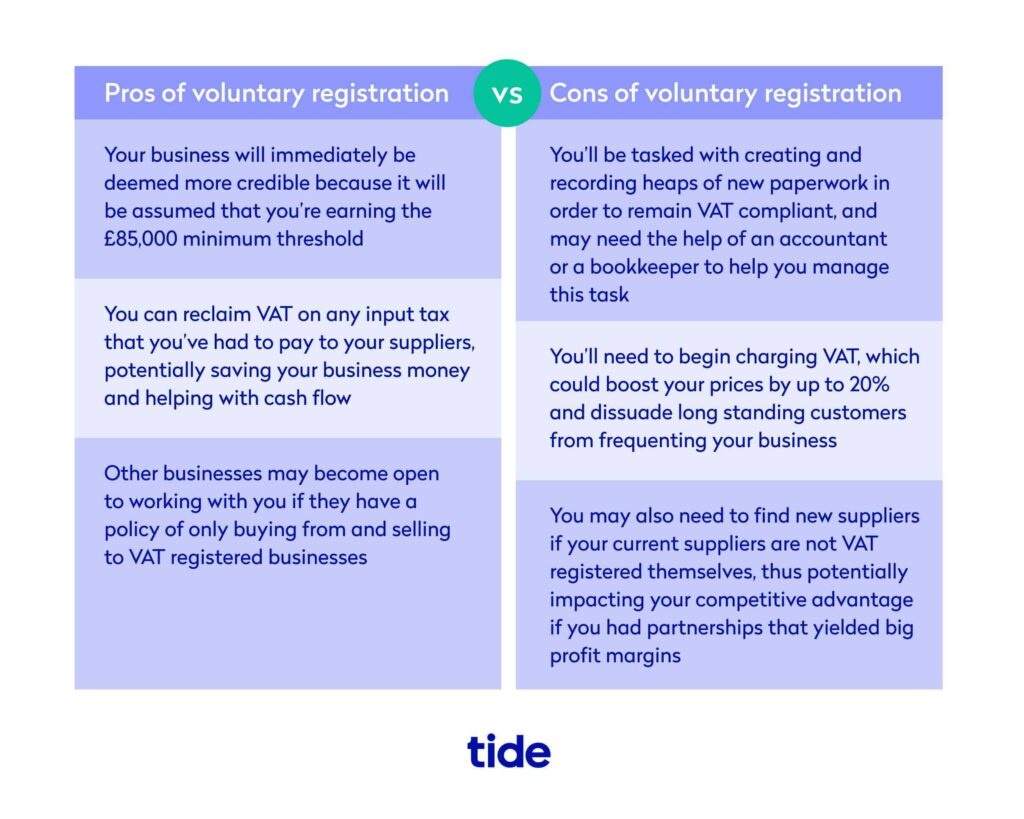

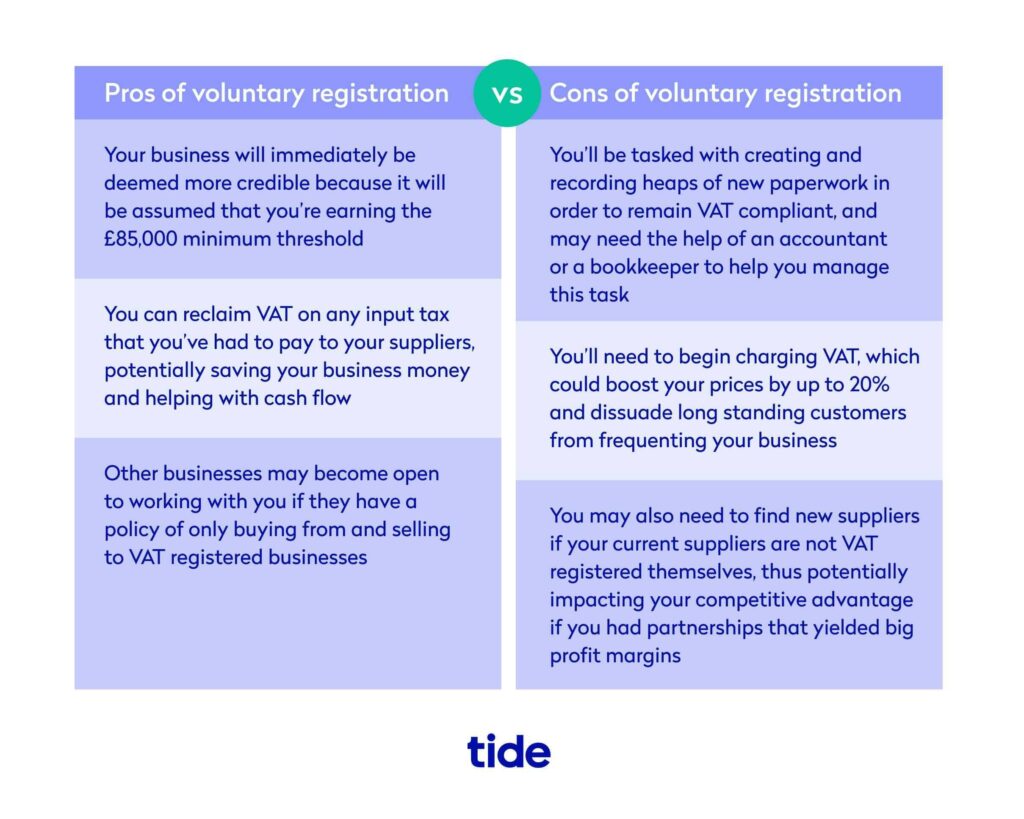

In many cases, before sole traders, partnerships and limited companies can start collecting VAT, they must register with the UK government for VAT number. However, VAT does not apply to all commercial transactions. VAT registration is required only for businesses earning significantly moreover £85,000 a year. However, entrepreneurs earning less than this minimum can also voluntarily register for VAT if they really want to.

How To Register For VAT

If you register for VAT you can also apply online. on the GMRC website. You will then receive a VAT number to use on your HMRC billing reports.

When Should I Register For Sales Tax?

You should definitely register for sales tax if you think your favorite sales are likely to exceed the allowance within the next 30 days. Sometimes you need to register for VAT if the audience has a purchase as a requirement and they are already registered for VAT.

“Reasonable Excuses” For Forgetting To Register For VAT

HMRC expressly agrees to waive its penalties under certain circumstances that are considered “reasonableexcuses”, this mainly includes situations that are beyond your control and unexpected events. So, what is a reasonable excuse for forgetting to register for VAT?

VAT Penalties For Late Payment

The VAT penalty depends on whether it is “fault” and what percentage of potential VAT revenue is lost. check if there is a “malfunction” and whether it is slowly smeared; Intentional, but not hidden or not only intentional, is taken into account.

At What Level Is VAT Accrual Likely?

The VAT accrual standard is 20%. Some goods are charged at lower rates, for example, children’s swimwear is charged at 0%, while household fuel, for example. gas chamber, a reduced rate of 5% will be charged.

Updated

Are you tired of your computer running slow? Annoyed by frustrating error messages? ASR Pro is the solution for you! Our recommended tool will quickly diagnose and repair Windows issues while dramatically increasing system performance. So don't wait any longer, download ASR Pro today!

Existing Fine Discount

Companies that already have a fine in their name will receive a discount of at least 30%% of the originally allowed amount. In order for a business to be eligible for the rebate, a VAT registered taxpayer must meet a number of specific conditions, including payment of all dues Current taxes and 30% unpaid administrative fines until December 31, 2021.

>

What Are The Deadlines For Filing Problematic Cyprus VAT Returns?

In case of false declarations or late filing of Cypriot VAT, foreign companies can be directly fined. Late submissions are subject to a fee of EUR 51 per return. There is also a fee of 85 euros per month for not registering with the tax office. Late payment will result in a surcharge of 10% on VAT payable plus late payment interest at the current rate of 4.5% per annum. In the event of an incorrect VAT declaration, an additional 10% will be charged on the amount of VAT payable, since annual interest will be charged on the output VAT plus a 10% penalty. In case of tax evasion, penalties of 300% of the amount of VAT spent are imposed.

What Is The VAT Threshold?

The VAT registration threshold is currently £85,000. If your valuable earnings exceed this figure, you should register as a as soon as possible. There is a 30-day grace period for registration, and this frustration can be costly for businesses.

What happens if you don’t register for VAT UK?

Before we go into detail, what can happen if you don’t register your own business for VAT at the right time when the registration expires?

Edit And Re-invoice After VAT Registration Is Approved

If you If you If you received certificate during VAT registration, your VAT settings can also be updated by your account manager. This allows you to edit invoices dated after the effective date of your invoices to convert them to VAT invoices that can be re-issued to help you with your client/representative.

Speed up your computer today with this simple download.등록하지 않은 경우 VAT 벌금을 징수하는 이유와 해결 방법은 무엇입니까?

Quali Sono Le Ragioni Per Riscuotere Le Sanzioni IVA In Assenza Di Registrazione E Come Risolverle

¿Cuáles Son Las Razones Para Cobrar Multas De IVA En Ausencia De Registro Y Cómo Solucionarlas?

Quelles Sont Les Raisons De Percevoir Des Amendes De TVA En L’absence D’enregistrement Et Comment Y Remédier

Jakie Są Powody Pobierania Kar VAT W Przypadku Braku Rejestracji I Jak Je Naprawić?

Quais São As Razões Para A Cobrança De Multas De IVA Na Ausência De Registo E Como Corrigi-las

Was Sind Die Gründe Für Die Erhebung Von Mehrwertsteuerstrafen Bei Fehlender Registrierung Und Wie Können Sie Behoben Werden?

По каким причинам взыскиваются штрафы по НДС при отсутствии постановки на учет и как их исправить

Vilka är Skälen Till Att Ta Ut Momsböter I Avsaknad Av Registrering Och Hur Man åtgärdar Dem

Wat Zijn De Redenen Om Btw-boetes Te Innen Als Er Geen Registratie Is En Hoe Deze Op Te Lossen?