Table of Contents

Updated

Over the past week, some of our readers have stumbled upon the well-known Richard Roll test bug. There are a number of factors that can cause this problem. Let’s take a look at them below.

You can also call a community member to discuss options

membership

Richard Roll, in his article on Using the Financial Asset Pricing Model (CAPM) to Assess Selection Effectiveness, pointed out that once an error is found in the standard used, it becomes impossible to assess portfolio management capabilities.

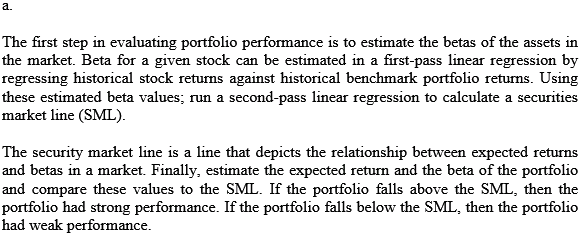

a. When assessing portfolio performance, describe the actual overall process with emphasis on the standard used.

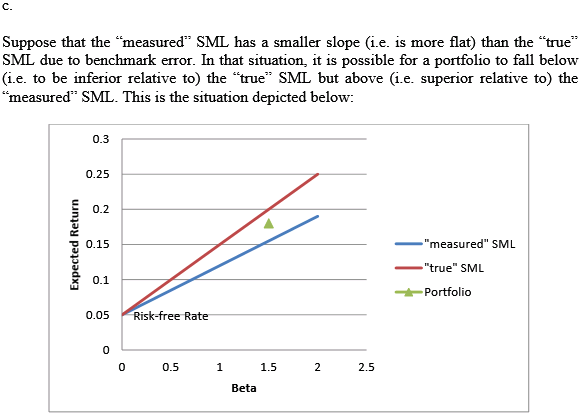

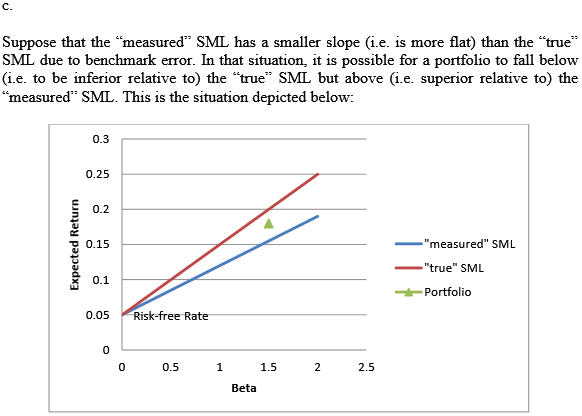

b. Explain what Roll means by standard error and use this link to identify the specific problem.

c. Drawdown graph showing how a portfolio rated above the “measured” bond market line (SML) can be lower than the “true” SML.

d. For example, suppose you know that a particular portfolio manager scored higher on the Dow Jones Industrial Average, my S&P 500 and the NYSE Composite Index. Explain if this will help the person learn true Profile Manager skills.

e. While one can be confused about benchmarking errors, for example in role, some argue that this does not mean that the CAPM is wrong, which means that it is someone who has a measurement problem while executing a theory. Others argue that all technologies really should be reversed because of the underlying error rate. Take one of these positions and defend it.

Pacific Stock Markets and Unknown Capital Investment Prices

- Yu Yang, Peter Shian-rong Chow, Mao-Wei Hong

- Economy < / li>

- 2000

Summary In this article, we follow the example of Harvey (1991) to determine if the performance of the Pacific Rim equities can be explained using a notional version of International Capital Asset Pricing. Development

-

17

- Tom Arnold, Lance A. Nail, Terry D. Nixon

- Business people

- 2004

-

12

- Economy

- 2001

- A. Charteris

- Economy

- 2009

-

1

- Constance Furaha Mwahunga

- Business

- 2013

-

1

- R. Bhargava, John G. Gallo, Peggy E. Swanson

- Economics

- 2001

-

21

-

36

- B. Sieux, R. Sweeney

- Economics

- 2000

-

5

- John J. Gallo, Peggy E. Swanson

- Economics

- 1996

-

50

- Juan Carlos Matalin, Louise Nieto

- Economics

- 2002

-

24

Does ADR improve wallet functionality for a national wallet? Testimony of my 90s

Summary American Certificates of Deposit (ADRs) are becoming an increasingly popular and practical vehicle for international investment. We estimate ADRthroughout the 1990s trading and discover that these … Expand

< / ul> Paula A. Tkach

The 90s saw a tremendous growth in your current international mutual fund assets. This expansion is expected to continue as more companies seek to diversify assets that … grow globally

< li>

Applicability to a risk-free interest rate proxy in South Africa: a zero beta approach.

The Capital Asset Pricing Model (CAPM), despite self-criticism and debate over its validity, remains one of the most widely used models for estimating the cost of equity for use in financial budgeting

< / ul>

Assess the importance of the return interval for assessing the systematic risk of companies listed on the relevant Nairobi stock exchange

Systematic risk assessment is often used in commodity analysis and portfolio management. A popular indicator of systematic risk is the CAPM test. CAPM declares that … Development

< li>

International wealth managers’ performance, asset allocation and investing style

This is an overview of the activities of 114 international shareholders from January 1988 to December 1997. The performance tests carried out used the characteristics of Sharpe (1966) and Jensen (1968) … Expand

This article describes a passive index that you can use as a benchmark for creating Commodity Trading Advisors (CTAs). The list is intended to diversify performance … Expand

Time-varying foreign exchange risk and additional central bank intervention: assessing returns on intervention and speculation

Failure to risk adjusting estimated gains regardless of foreign exchange intervention by the central bank or through hidden speculation can materially affect these perceived gains, including sign reversals. … Expand

< li>

Comparative performance indicators of US “international” equity funds

< / ul>

Summary This article analyzes the international two-index model within a single two-factor model of Arbitrage International Pricing Theory (IAPT) and evaluates the performance of 37 different mutual companies in the United States. Expand

Investment funds as the best alternative to direct equity investment: a cointegration approach

Strong growth in mutual resources (FIM) in Spain in recent years raises the question of whether an investor pursuing an indirect management strategy can compare these funds with a serious alternative. ..

< / ul>

Speed up your computer today with this simple download.

Conseils De Dépannage Du Manuel De Richard Roll

Richard Rolls Handbok Felsökningstips

Tips Voor Het Oplossen Van Problemen In Het Handboek Van Richard Roll

Consejos Para La Resolución De Problemas Del Manual De Richard Roll

Richard Roll의 핸드북 문제 해결 팁

Wskazówki Dotyczące Rozwiązywania Problemów W Podręczniku Richarda Rolla

Dicas De Solução De Problemas Do Manual De Richard Roll

Suggerimenti Per La Risoluzione Dei Problemi Del Manuale Di Richard Roll

Советы по устранению неполадок в Справочнике Ричарда Ролла

Tipps Zur Fehlerbehebung Im Handbuch Von Richard Roll